Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 13, 2012

AllInvesting

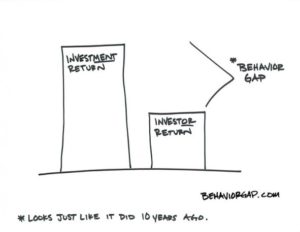

Dalbar, an independent communications and research firm, has done countless studies trying to quantify the impact of investor behavior on real-life returns. Their studies focus on the difference between investors’ actual returns in stock funds to the average return of the funds themselves. Basically, they are comparing the return the investor gets to the return the investments get.

The results are eye-opening! In 2011 Dalbar found that the average equity fund investor underperformed the broad U.S. index return (S&P 500) by 7.85%. This difference in return comes from investors making classic behavioral mistakes time and time again. In my eyes, an investor’s biggest hurdles to reaching financial success are their own ego and emotions, and these are probably the two hardest things to overcome!

The results are eye-opening! In 2011 Dalbar found that the average equity fund investor underperformed the broad U.S. index return (S&P 500) by 7.85%. This difference in return comes from investors making classic behavioral mistakes time and time again. In my eyes, an investor’s biggest hurdles to reaching financial success are their own ego and emotions, and these are probably the two hardest things to overcome!

The numerous market gyrations of the past decade have challenged even the most disciplined investors and caused many people to run for safety. These tend to be the most challenging times for us as advisors, because it involves avoiding what feels like a good decision at the time and helping you come up with what might be the more logical one. Basically, helping YOU, not your EMOTIONS, run your retirement account.

The two vertical lines on the graph at right (at March ’09 and September ’11) represent the times in which we fielded the most client calls here at Rockbridge. The markets were down drastically and, rightfully so, investors were nervous about what to do with their money. The common theme we heard was, “Should we pull the money out now and wait for the market to gain some stability?” Much to their discomfort at the time we did the contrary and held course. The blue line shows the outcome of staying invested for the full decade, while the red line shows how moving out of the market and into “cash” at the wrong times can affect your long-term performance. In this particular scenario, poor timing in the market cost the investor over $70,000 during the decade.

The two vertical lines on the graph at right (at March ’09 and September ’11) represent the times in which we fielded the most client calls here at Rockbridge. The markets were down drastically and, rightfully so, investors were nervous about what to do with their money. The common theme we heard was, “Should we pull the money out now and wait for the market to gain some stability?” Much to their discomfort at the time we did the contrary and held course. The blue line shows the outcome of staying invested for the full decade, while the red line shows how moving out of the market and into “cash” at the wrong times can affect your long-term performance. In this particular scenario, poor timing in the market cost the investor over $70,000 during the decade.

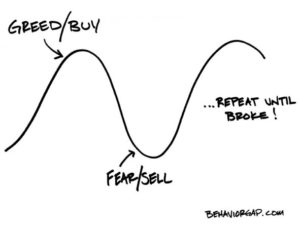

The picture below also illustrates what not to do in investing. If you buy when the market is up, or sell when the market is down (out of fear or your emotions), you will do nothing but hurt yourself financially. So maybe we need to look at this drawing upside down and remember what Warren Buffet continually preaches: Be fearful when others are greedy and greedy when others are fearful!

Buffet continually preaches: Be fearful when others are greedy and greedy when others are fearful!

Remember that successful investing is about “controlling the controllable and ignoring the rest.” We can’t control the direction of the financial markets, but we can avoid making costly mistakes by attempting to do so. The smartest people I know are the ones who understand that they don’t know everything and put policies in place to protect their portfolios from their own emotional behavior. When it comes to financial success, slow and steady does WIN the race!

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.