Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 20, 2010

AllInvestingNews

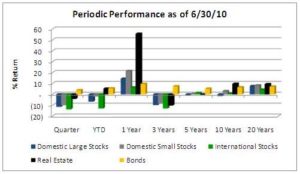

First quarter stock market gains were erased during May and June leaving values well below the high water mark reached in the fall of 2007. As the chart shows, large-cap stocks (S&P 500) have lost nearly 10% annually over the past three years. Markets reacted to increasing uncertainty and unfavorable economic news and reversed the trend of the previous four quarters. One-year returns reflect the substantial improvement from the March 2009 trough but year-to-date returns for stocks are in the red.

The volatile real estate sector remains in positive territory for the year, and bonds stand out as they provide diversification and stability for investor portfolios. Note how the low but stable bond returns now look very attractive across all trailing periods.

The volatile real estate sector remains in positive territory for the year, and bonds stand out as they provide diversification and stability for investor portfolios. Note how the low but stable bond returns now look very attractive across all trailing periods.

Signs of fear

I love the drama in this paragraph from a recent Wall Street Journal article:

Volatility returned to global financial markets with a vengeance in the second quarter, sending investors fleeing from stocks worldwide and driving them into defensive investments, especially U.S. Treasurys and gold.

Did I miss something? Should I have known enough to get ‘defensive’ last quarter? First let’s think about this quote for a moment. The issuance and redemption of stock for major companies over the past six months has been trivial, so investors collectively did not ‘flee’ the stock market – the ones who were scared just sold their shares to some other investor…at a much lower price than they could have three months ago.

So what did happen? Well it sounds much less dramatic – events such as the Greek debt crisis, stubborn joblessness, increasing deficits, and the BP oil spill raised concerns about economic recovery and future growth. These concerns, and increasing uncertainty, caused the market’s calculation of current stock values to decrease, and the value of Treasury bonds to increase.

Will stocks decline in value further next quarter because the recovery has stalled? Maybe…of course this potential outcome has already been considered by market participants and is built into today’s prices. If signs of a double-dip recession become more apparent, then sure, stock values are likely to decline further. But the future is unknowable, and signs of recovery could boost stock prices. Today’s market price reflects the value paid by a willing buyer and prices reflect uncertainty.

Why should we expect future returns to be different than the recent past?

Let’s start with the bond market where we see an average ten-year return of 6.5%. The bond index today has a yield of about 4% meaning that if all the bonds in the index were held to maturity, the return would be 4%. In order to realize a higher return in the short-run, interest rates need to fall but there is little room to fall from current levels. It seems more likely that interest rates will rise at some point, making bond prices fall, and depressing short-term returns. So, it is unlikely that bond returns over the next ten years will be as high as the past ten years.

Returns from stocks over the past ten years look dismal compared to bonds with small stocks providing 3% and large stocks providing negative 1.6% annual returns. Nonetheless, it is reasonable to expect stocks to provide a risk premium. If the additional return were consistent or predictable, it would no longer be warranted. It is precisely because stock returns are volatile and unpredictable that investors can expect a higher return from stocks than from bonds.

With 20/20 hindsight it is easy to conclude that stocks were overvalued ten years ago. Too little risk and uncertainty was built into stock values as investors paid astronomical prices for the latest technology idea with no earnings in sight. As we approached the cliff of financial collapse in the spring of 2009, fear and uncertainty was priced into everything. As fear abated, stock values jumped. We saw a reversal of this in the past two months.

It is now easy to find predictions that the Dow will fall to 1000, losing 90% of its current value before the world economy straightens out. This is not impossible but seems very unlikely. It is also easy to generate agreement in casual conversation that the outlook for stocks is bad and a poor place for retirement savings – not surprising amidst the current barrage of emotionally presented negative news.

Anecdotally these predictions give me comfort that current prices are reasonable, and capable of providing returns similar to our long-term expectations. As Warren Buffett said, “Be fearful when others are greedy, and be greedy when others are fearful.” The fact that fear has returned to stock markets may be good news for investors who take a consistent, long-term approach.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.