The Value of Taxable Brokerage Account Assets for Early Retirement

For those planning to retire early, traditional retirement accounts such as 401(k)s and IRAs, while tax-advantaged, present some limitations. This is where taxable brokerage accounts become a powerful and flexible financial tool. They offer early retirees strategic advantages, including liquidity, control over taxable income, and the ability to fund essential expenses like healthcare and lifestyle […]

Politics and Your Portfolio: Why Diversification is Your Best Defense

In the wake of U.S. elections, emotions often run high — especially when it comes to how political outcomes might affect financial markets. Financial Planning magazine asked 320 advisors “how will the US election outcome influence your retirement plan?” A staggering 90% anticipated a negative impact on their clients’ portfolios. This survey was from 2016, […]

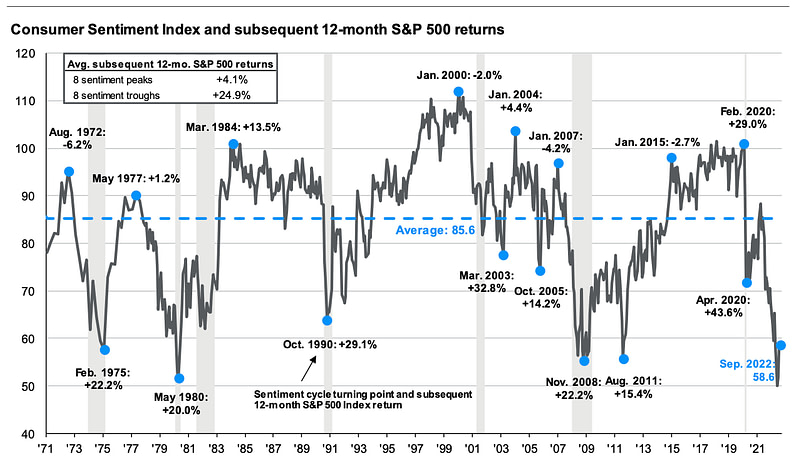

Consumer Sentiment Vs Market Returns

It’s safe to say that both, market prices and investor confidence have taken a hit since the start of the year. Heading into 2022, we had experienced three years of S&P 500 performance averaging over 20% annually- not to mention this was all while dealing with a global pandemic. Since then, the S&P 500 has […]

How Accurate Are Market Predictions?

If you ask 100 different financial “experts” about future stock market performance, you’ll get 100 different opinions. Most will be wrong, but some, by sheer luck, will be correct (luck is often confused for skill). Investors often rely on expert opinions on what to do with their investments, especially in volatile markets like we are […]

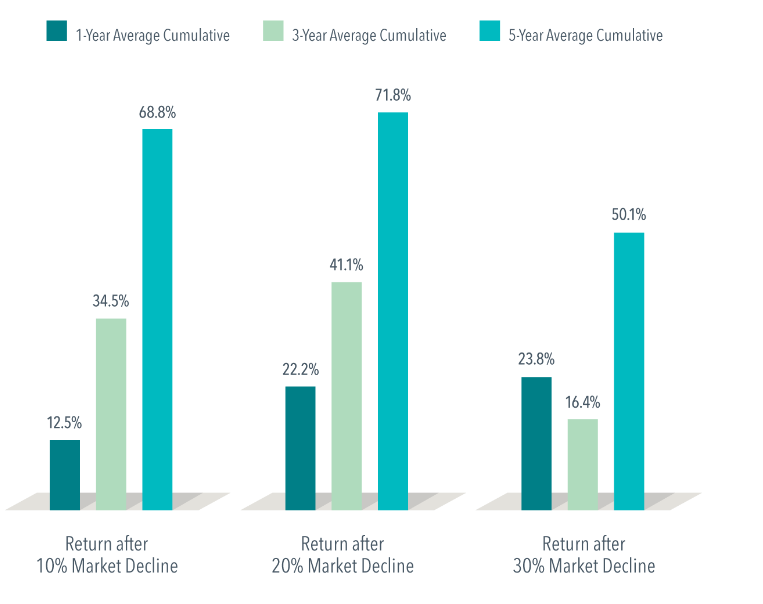

Bear Markets – What do they mean for investors in the long-term?

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

Six Ways a Recession Resembles a Bad Mood

There’s been a lot of talk about recessions lately: Whether one is near, far, or perhaps already here. Whether we can or should try to avoid it. What it even means to be in a recession, and how it’s related to current market turmoil. To put market and recessionary concerns in perspective, it might help […]

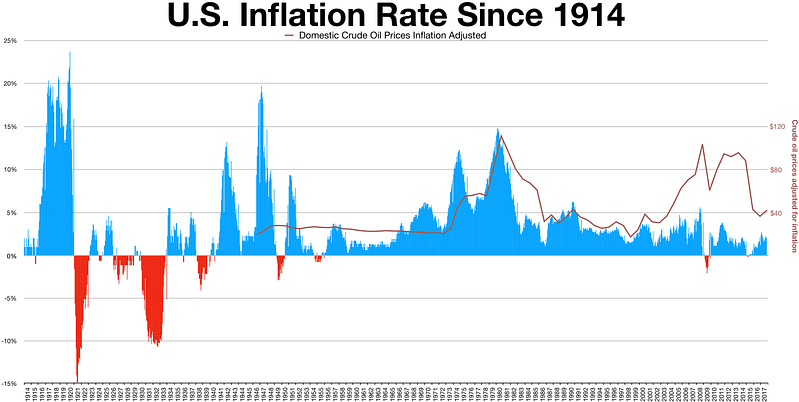

Ignore the Headlines

Recent headlines have been dramatic as “Inflation Soars to Highest level in 40 Years!” and “Stocks Plunge to 2022 Lows!” It sounds like the authors are all shouting, and we should really panic. It feels like we should “do something” but let’s take a step back from the headlines, and put today’s market in perspective […]

Volatility – Like it or Not – is a Feature of Markets

Stock and bond markets alike are sorting their way through a potent brew of uncertainties these days. War, inflation, supply constraints, rising interest rates, growth concerns, and even crypto-currency dislocations are combining to drive markets lower by the day. It’s certainly no fun to sit through tumultuous markets, but turmoil like we’ve seen recently is […]

Is inflation haunting your financial dreams? Part 1: what we know

Has the specter of inflation got you spooked? Recent headlines are filled with sightings. In this two-part series, let’s take a closer look at what to make of all the commentary, and what you can do about it as an investor. First and foremost, we caution against succumbing to fear or panic in the face […]

Historical stock market volatility around elections

With the general election approaching, many investors are worried about heightened volatility in the stock market. We have had several people reach out with three types of concerns: concern around an election without a clear winner (or a candidate not admitting defeat), concern around an election result different than their preference, and concern around general […]