How Accurate Are Market Predictions?

If you ask 100 different financial “experts” about future stock market performance, you’ll get 100 different opinions. Most will be wrong, but some, by sheer luck, will be correct (luck is often confused for skill). Investors often rely on expert opinions on what to do with their investments, especially in volatile markets like we are […]

Bear Markets – What do they mean for investors in the long-term?

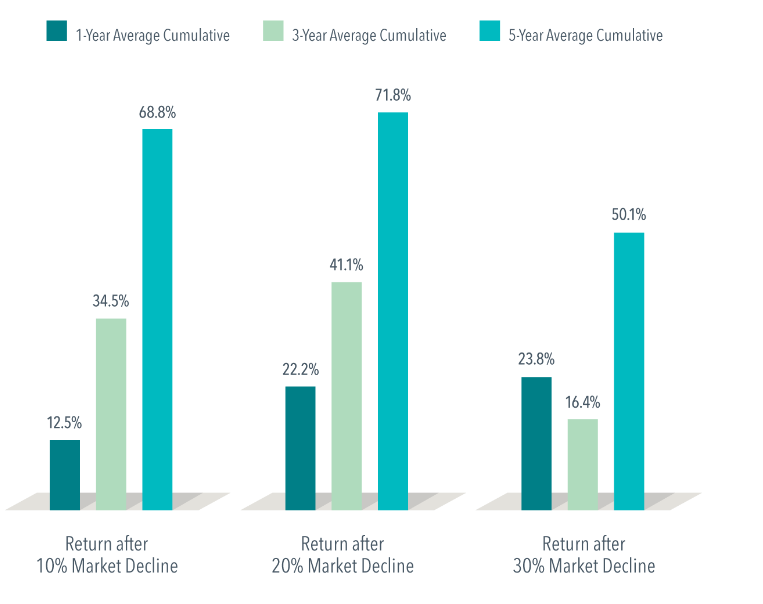

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

Six Ways a Recession Resembles a Bad Mood

There’s been a lot of talk about recessions lately: Whether one is near, far, or perhaps already here. Whether we can or should try to avoid it. What it even means to be in a recession, and how it’s related to current market turmoil. To put market and recessionary concerns in perspective, it might help […]

Ignore the Headlines

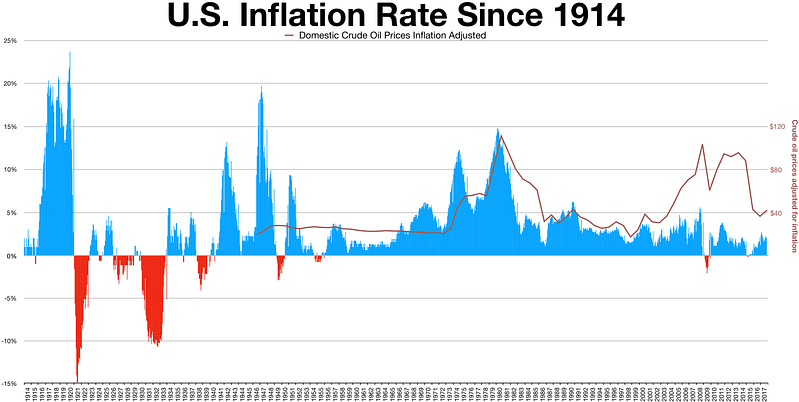

Recent headlines have been dramatic as “Inflation Soars to Highest level in 40 Years!” and “Stocks Plunge to 2022 Lows!” It sounds like the authors are all shouting, and we should really panic. It feels like we should “do something” but let’s take a step back from the headlines, and put today’s market in perspective […]

Capital Market Activity – 05/31/2022

Stock Markets Although rebounding lately, all markets are down year to date. Since December stock markets are off more than 10%. Tech stocks are especially hard hit – an equally weighted portfolio of the largest domestic tech stocks (Apple, Microsoft, Amazon, Google, and Facebook) is off 25%. The premium to value markets, domestic and international, […]