At Rockbridge, you won’t find any product pitches, birthday cards, or pictures of over-the-top beaches and Goldendoodles (although we do love dogs). You’ll get straightforward, rock-solid investment advice in terms you can understand without unnecessary costs or complexity. We’re a fee only financial advisor, so there’s never any conflict of interest. And we insist on complete clarity at Rockbridge—after all, you can’t be confident about your decision if we aren’t speaking your language.

The following are examples of the types of clients we serve and the financial situations we help with.

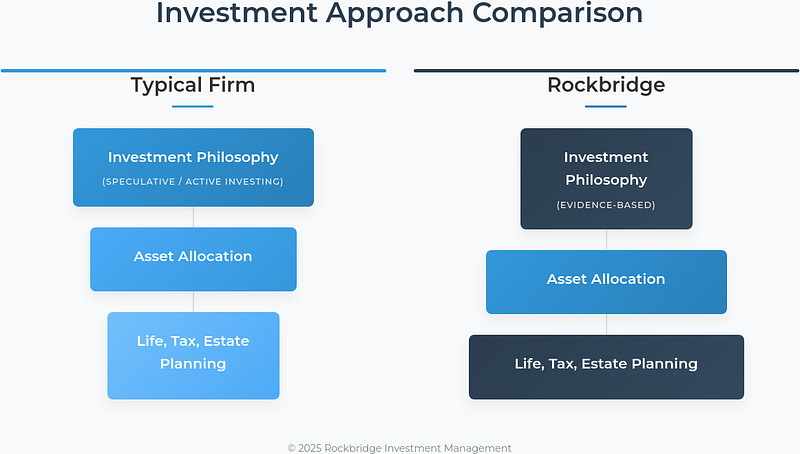

(speculative / active investing)

(evidence-based)

It really comes down to prioritizing what actually moves the needle in your financial life. Trying to out-perform the market through active managers adds the least amount of value in a diversified portfolio, yet charges the largest fees. At Rockbridge, we focus on the factors you can control: how much risk to take, what mix of investments, and how much the investments cost, all while prioritizing your life, tax, and estate planning needs.

The financial services industry has rewarded selling products for decades. As much as advisors claim to do “financial planning,” most are simply not structured or qualified to provide clients with the advice they need. They are built on a traditional model of investment management – a model that’s outdated. At Rockbridge, we’re different. We’ve designed a new model from the ground up that revolves around helping clients achieve more, keep more, and do more, all for a fair cost. No client should settle for any less. And because we’re a fee only investment advisor, it’s in our best interest to see you make more money.

Your financial journey starts here. Let's connect, discuss your vision, and explore if we're the right match to help achieve your goals. Together, we'll set the stage for your personalized financial plan.

Financial planning, simplified. Your life changes—so does your plan. We adapt with you, turning goals into reality.

We’ll ensure your plan fits your unique needs and confirm you fully understand every step. Once you're ready, we'll handle all necessary details smoothly.

Markets move. Life evolves. Your plan should too. We continuously monitor results, ensuring your goals stay within reach.

No gimmicks, just clear and honest financial advice you can trust. We’re fee-only advisors—no hidden agendas or conflicts of interest. At Rockbridge, clarity comes first, so you’re always confident in your financial decisions.

You deserve financial services that deliver maximum value without excessive fees.