Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 11, 2019

AllInvestingNews

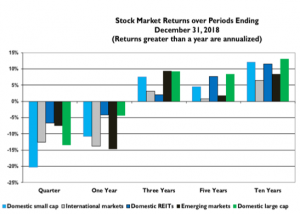

December’s market reminds us that risk is real – even after the uptick at the end of the month, a global stock portfolio is down about 15% for the quarter and 12% for the year. Technology stocks (Amazon, Apple, Microsoft, Google, Facebook, Netflix), which have been driving the market to new heights in recent years, were off nearly 20% this quarter.

December’s market reminds us that risk is real – even after the uptick at the end of the month, a global stock portfolio is down about 15% for the quarter and 12% for the year. Technology stocks (Amazon, Apple, Microsoft, Google, Facebook, Netflix), which have been driving the market to new heights in recent years, were off nearly 20% this quarter.

Future returns depend on news, which, of course, can’t be predicted. (If it could it wouldn’t be news!) Maybe markets have exaggerated today’s concerns or maybe there is more to go. For sure, increased volatility lies ahead. We have been lulled into a stock market that has provided a mostly smooth ride upward over the past few years. That pattern is not typical – risk matters.

Up until now, the market has shrugged off the myriad of issues that have been plaguing us for a while. These include: international trade wars and tariffs, rising interest rates, privacy and social media concerns, impact of last year’s Tax Bill, resolution of Brexit, slowdown in global growth, sliding oil prices, political dysfunction and Government shutdowns. Market prices reflect a continuing forecast of the eventual economic impact of these issues. In December, these forecasts turned negative.

The ten-year numbers above tell us there is a reward for enduring the normal ups and downs of stock markets, including recent results.

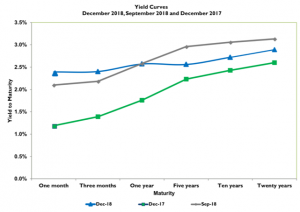

Bonds earned positive returns for the quarter, fulfilling their role of reducing the overall risk of a diversified portfolio.

The shape of bond yields across various maturities is unusual. Even as the Fed increased interest rates, the market-determined yields on longer-term bonds fell. This pattern can be a harbinger of a difficult economic environment ahead. On the other hand, it is also consistent with an overall move to reduce exposure to risky assets.

We are now dealing with the risk side of investing, which we can divide into two categories: (1) the impact of factors that affect all securities, and (2) the impact of what affects only an individual security. By diversifying, the effect of any individual security becomes minimal. Expected return is the reward for enduring the variability of market-wide uncertainties.

Stock markets are risky, but what about the eventual reward? Do investors eventually earn what they expect? We look for answers in two places: (1) If market participants, who are constantly buying and selling, didn’t eventually earn what they expect, they wouldn’t play, and (2) There is evidence that over the long run, returns tend toward long-term averages. But long-term means long and succumbing to short-term variability ensures failure. It’s why risk matters. It’s why the urge to give up makes success hard to achieve.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.