Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 15, 2021

Investment Committee

Stock Markets

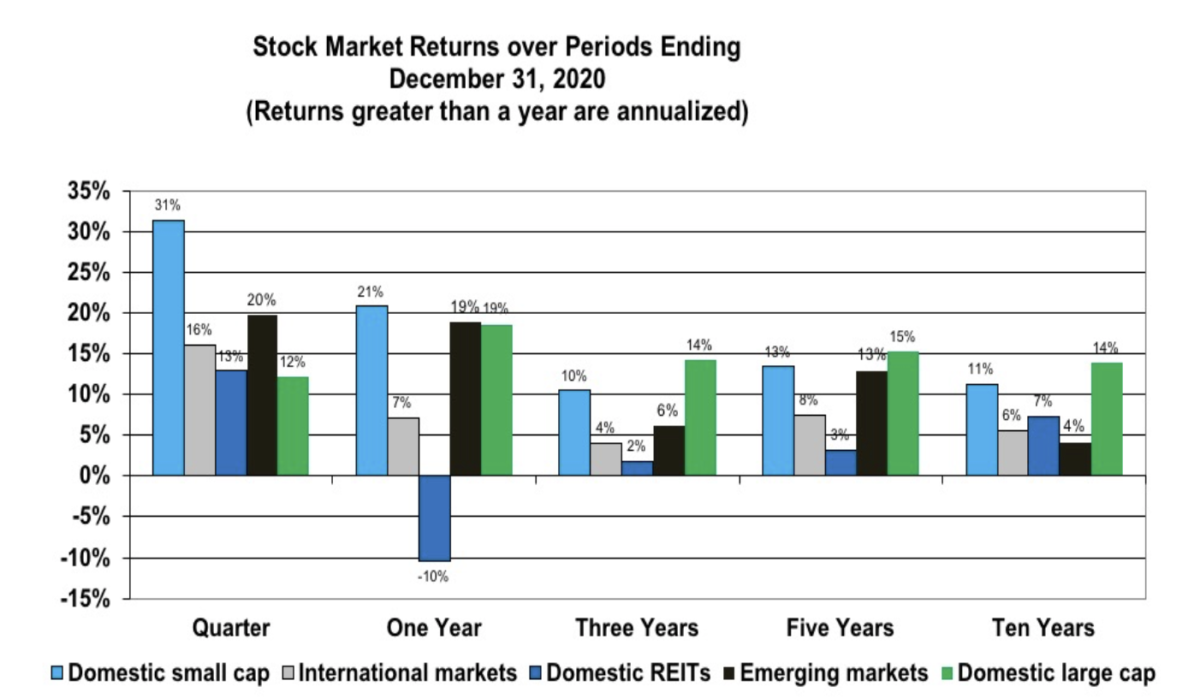

Results over the past quarter are consistent with positive expectations due to the introduction of vaccines in November. Small company stocks and Real Estate markets have snapped back but not enough to bring the past year’s Real Estate returns into positive territory. Over longer periods, domestic stock markets have outpaced international and emerging markets.

Bond Markets

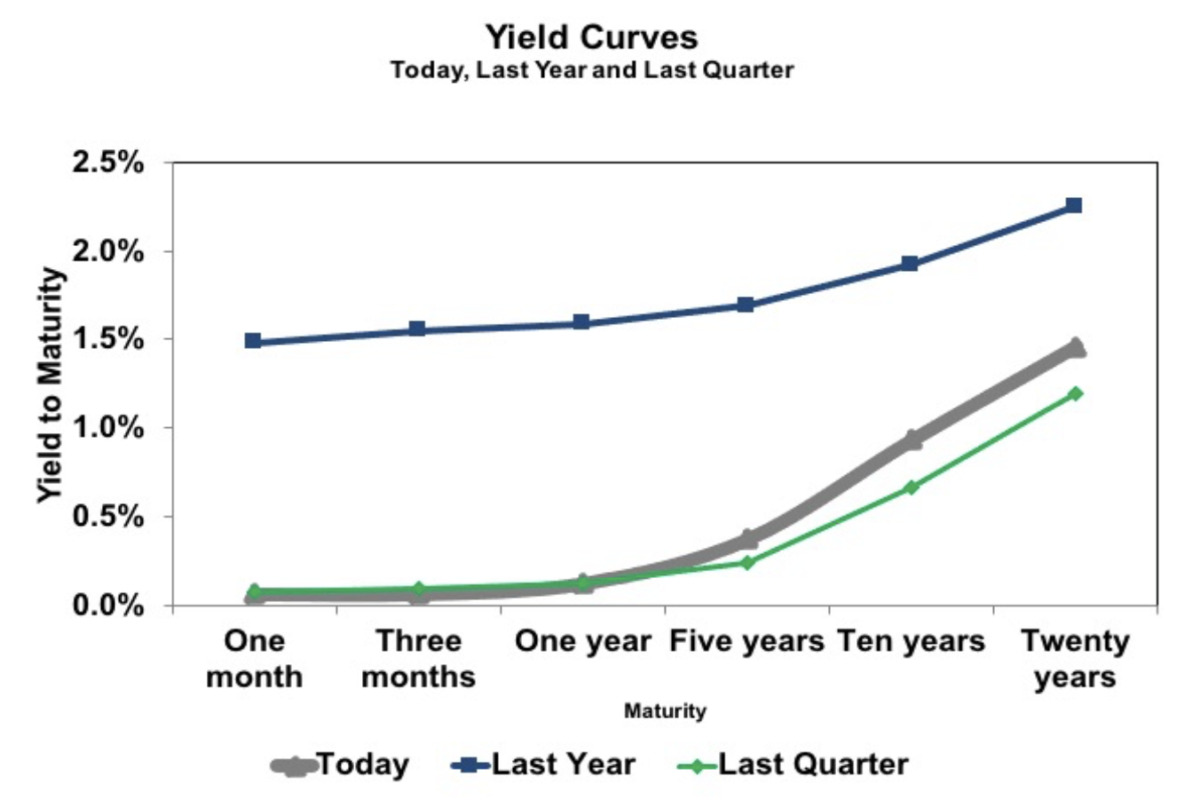

The Yield Curve shows the pattern of observed returns from holding Bonds to term across several maturities. Today these yields go from essentially zero to about 1.5% across a twenty-year spectrum. Yields have dropped since a year ago, which explains positive returns over the past year, especially those for longer maturity Bonds. On the other hand, yields have increased at the long end of the curve over the most recent quarter, impacting returns for longer dated Bonds negatively.

The slope of today’s yield curve has steepened over the past quarter which is consistent with expectations for increased interest rates.

A Perspective on 2020

2020 gave us one extraordinary event after another: a hundred-year pandemic that has taken over 350,000 American lives; lockdowns and quarantines producing massive unemployment and a deep recession; a government in disarray capped off by a contested Presidential election; Black Lives Matter protests; one hurricane after another; and unrelenting wildfires across the West. Now, we have scientific break throughs producing Coronavirus vaccines in record time. This development plus an essentially resolved Presidential election means we can begin to see a “light at the end of the tunnel.” Signals from capital markets seem to be telling us so.

Throughout the year capital markets responded to these events. Not only were stocks volatile but Bond yields dropped significantly as monetary policy and markets reacted to the onset of the pandemic and remained close to zero. Yields on inflation-adjusted Bonds like TIPS dropped below zero and stayed there.

During 2020 the stock market returns were not only volatile but were inconsistent among the various markets. Over the first nine months the largest U.S. Tech companies fared reasonably well – other markets fell short. Those who told us the “market” came back after the initial fall off in March were only talking about the S&P 500, which is driven by these largest Tech companies. The numbers tell this story: Over the period ending September 30th, the S&P was up nearly 6% while a globally diversified portfolio was off almost 8% – a 14% difference. With the announcement of an effective Coronavirus vaccine in November we get a different story. While all markets were up in the fourth quarter the S&P 500 did not keep pace – the worldwide portfolio earned 20% versus 12% for the narrowly focused S&P 500. All in all, however, stocks earning better than 10% over this truly extraordinary year is not bad!

With the onset of the pandemic, Bond yields dropped significantly and have remained low. While yields at the short end, which are most affected by the Fed, remain close to zero, yields at the longer end have increased in recent months, which is consistent with expectations for an improving economic environment. Bonds were strong in 2020– earning from 3% to 10% over the year depending on maturity. Most of these results came in the first quarter after the sharp fall-off in yields.

Markets look ahead and recent activity is consistent with positive expectations for a recovery from the effects of the Coronavirus vaccines. As the economy improves, perhaps the Fed will feel less inclined to drive interest rates to zero. There is no doubt that the cost of money is at rock bottom and readily accessible. With this availability and a pent-up demand in both the private and public sectors, it is reasonable to expect an improved economic environment. While many uncertain ties remain, a pickup in the economy could produce more reasonable stock and Bond markets. Yet, 2020 was a stark reminder that markets are driven by surprises. Today’s environment feels a little more comfortable, and perhaps we can hope for positive surprises out-weighing negative surprises going forward.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.