Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 19, 2021

Investment Committee

Stock Markets:

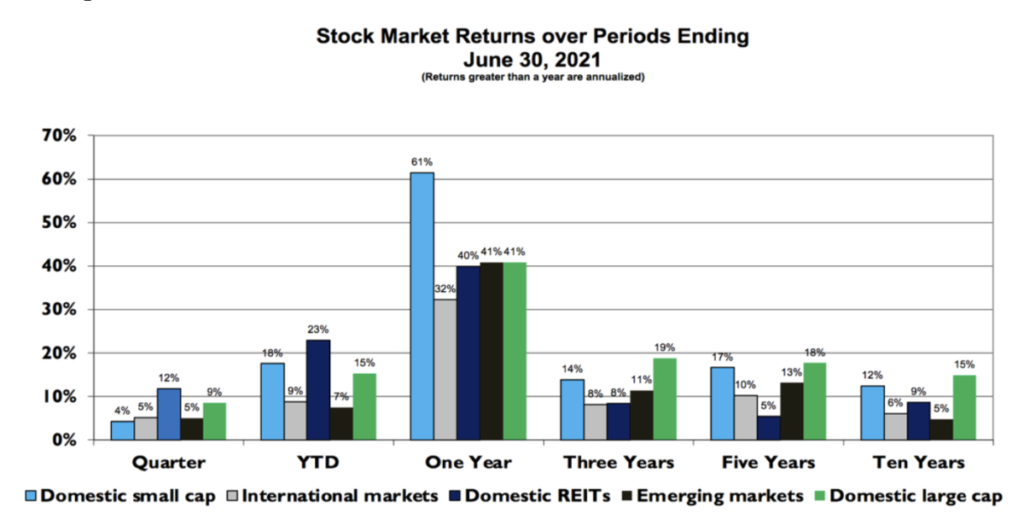

Stocks provided positive results over the most recent twelve-month period. While all markets have done well, especially stocks in domestic markets, the markets that lead and lag vary across the various periods.

While not shown in this chart, a globally diversified stock portfolio earned over 12% over the three-year period ending June 30th, which includes both the sharp fall-off due to the Pandemic and the recent snap back. These results once again demonstrate not only the futility of trying to predict markets, but also the importance of staying invested throughout market ups and downs.

Bond Markets:

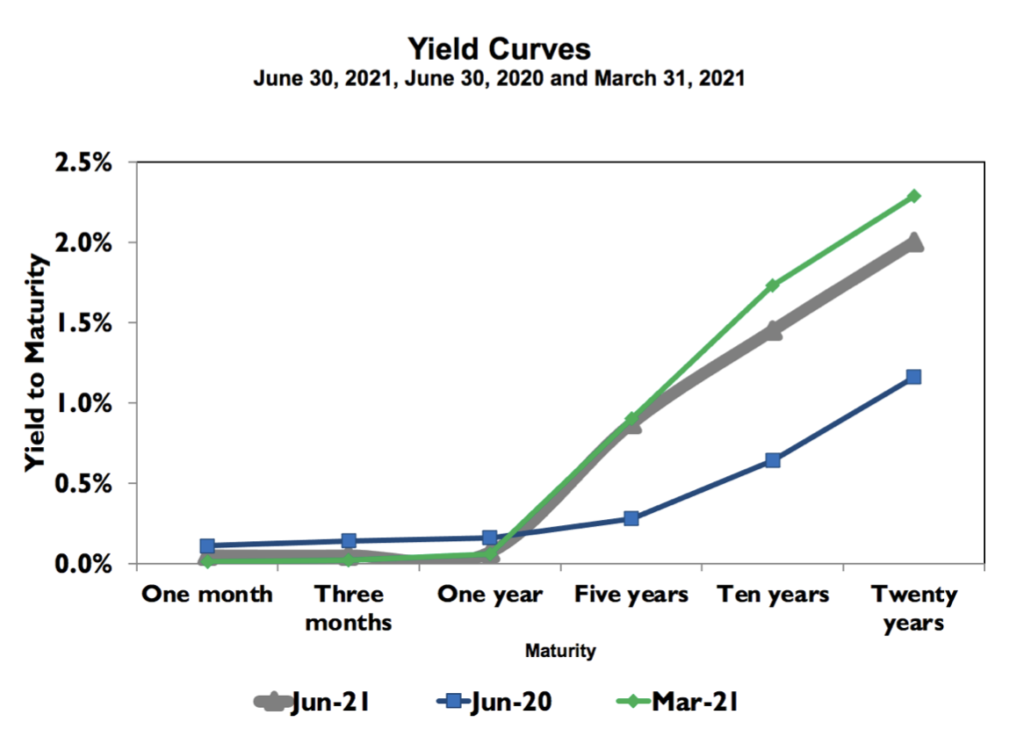

The Yield Curve below shows the pattern of observed returns from holding bonds to term across several maturities. Today these yields go from essentially zero to about 2% across a twenty- year spectrum. Yields for bonds of longer maturities fell a bit over the last quarter, which had a positive impact on those bond returns. Over the past year, on the other hand, yields have increased bond returns negatively – an index of Treasury securities maturating between 7 and 10 years lost 4.7% over the trailing twelve months.

Today’s Investment Landscape: Is there a piper to be paid?

In response to the Pandemic, the Government has run massive deficits and the Fed has re-implemented“quantitative easing”, which has been largely successful. The domestic economy is coming back, and employment has rebounded. The stock market as measured by the S&P 500 is up just over 40% and interest rates continue at historic lows. While successful to date, it is unknown if we will eventually have to pay the piper with higher interest rates and sustainable inflation down the road.

Conventional macroeconomic models tell us that deficits can produce inflation. Additionally, increasing prices may reflect temporary dislocations in this unique period. The sharp ups and downs of lumber prices are an example of the temporary nature price changes. The Fed governors and many commentators argue that this price activity will be short- lived and are reasonably calm about the prospects for sustainable inflation.

The Fed has been a massive buyer of U.S. Treasury securities and helps to explain why Treasury yields are at historical lows. However, when (if) the Fed begins to sell these Treasuries to bring its balance sheet back to more normal levels, unless done carefully, could drive bond yields back up.

The Long-term:

Today’s investment landscape is cluttered with many unknowns. The long-term is best thought of as the time it takes for actual results to equal what is expected, i.e., “regress to the mean”, which can be a long time and requires patience. Below average results in any market will not necessarily continue and above average results will not persist either. After the recent sharp run-up in stock prices, many of the metrics used to gauge market results signal a fully valued market. Markets can snap back quickly and getting out prior to earning what is expected will only assure below average results.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.