Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

July 19, 2019

AllInvestingNews

Stocks for this quarter maintained the above-average trend in the year-to-date numbers. The primary market drivers are the Fed activities and the status of tariff discussions with China and Mexico. As the prospects for reduced interest rates and resolution of the tariff negotiations wax and wane, stocks move up and down.

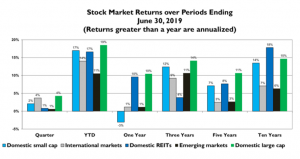

The graph below shows returns in several equity markets for various periods ending in June. A few things stand out: (1) domestic markets have done better than non-domestic markets; (2) there are significant differences among the various markets and; (3) while volatile, it was a reasonably good period for stocks. Keep in mind that ten years is a short period and that markets have no short-term memory – what we see here may not be indicative of what the next ten years hold. Consequently, the need for diversification.

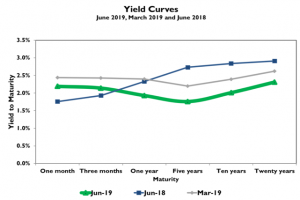

The yield curves below show what’s earned over several periods from holding U.S. Treasury securities to maturity. These curves are sometimes indicative of the future direction of interest rates – upward sloping is consistent with a reward for taking interest rate risk and increasing rates; flat and downward sloping for decreasing rates. Note the parallel shift downward over the past quarter – positive for bond returns. The typical yield curve slopes upward – greater return for longer maturities. Note the June and March yield curves do not follow this pattern. Look at the uptick in short-term yields and decline in yields for longer maturities over the past year – positive for long-term bonds, negative for short-term.

Diversification can bring short-term uncertainty, but unless you can predict the future consistently, it is still the best strategy for the long run. Holding a diversified portfolio means in most periods, there will be at least one market we wished we avoided. Recently, value stock returns are well under those in other markets. Yet, to realize the long-run benefits of diversification, we must deal with this short-term regret and uncertainty. There is evidence that over the long run, markets tend to move towards averages – periods of above-average returns are followed by periods of below-average returns.

Markets move as the prospects for tariff negotiations wax and wane. International trade ties world economies together – it’s fundamental to the workings of today’s global economy. Through time the world changes and comparative advantages shift. International trade continuously affects various industries differently. Recent volatility in stocks is consistent with ongoing trade negotiations with China and now Mexico. As the specter of increasing tariffs becomes an issue, markets tend to fall when first introduced, then rise with anticipated resolution. These ups and downs are something we must live with today.

All eyes are on the Fed and the prospect for reduced interest rates. While this noise is apt to be positive for stocks in the short run, it is hard to put together a compelling story for the longer term. First, the Fed can only directly affect short-term rates. Second, there is not much room for rates to fall from today’s historically low levels. Third, Fed actions only impact long-term rates and borrowing costs to the extent they change market expectations. Finally, the reason for a rate cut is an economic slowdown – generally not positive for stocks.

Stock prices are the present value of expected future cash flows, and so move in sync with an increase’s or decrease’s in expected cash flows and move inversely with interest rates. For reduced interest rates due to an economic slowdown, the positive impact of falling interest rates would offset the negative effect on expected cash flows. It appears the market is making that tradeoff today.

The impact the Fed has on the bond market is mostly perception. It can only affect short-term rates. A bond’s yield (the amount it will earn if held to maturity) depends to an important extent on expected inflation. Changes in these yields, which affect periodic returns, follow changes in expected inflation. This is where the Fed and bond returns come full circle – the Fed watches expected inflation and signals its views by adjusting short-term rates. While it is comforting to have explanations for short-term market behaviour, often it is random noise. This time around the explanation seems to be an anticipated reduction in interest rates by the Fed.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.