It’s hard, and often counterproductive to comment about breaking news while it’s still moving through the proverbial grinder … which is why we usually don’t do so. However, we feel it’s worth commenting on the current, growing number of regional bank runs.

Before taking a look at the details, we’ll lead with two larger assurances:

We’re Here, as Usual

If you have let us know about cash holdings at an affected bank, we are reaching out to you directly to help you navigate your next best steps. If you have such holdings we aren’t yet aware of, please let us know, so we can advise you accordingly.

Even if your money remains safe and sound, we are available to speak with you about any questions or concerns you have at this time. This is one of the biggest reasons you hired us: to serve as an informed sounding board during confusing times.

Our Broad Advice Remains the Same

As you know, we typically seek to optimize your personal long-term outcomes by recommending against reacting to near-term upsets. This philosophy is based on our own and others’ best thinking about how to improve your odds for investment success over time. As such, our strategy already expects that the unexpected WILL happen now and then. To a point, the stress of realized risks can even contribute to our expected returns.

Next, let’s summarize our understanding of the goings on, to aide in rational decision-making.

What Happened?

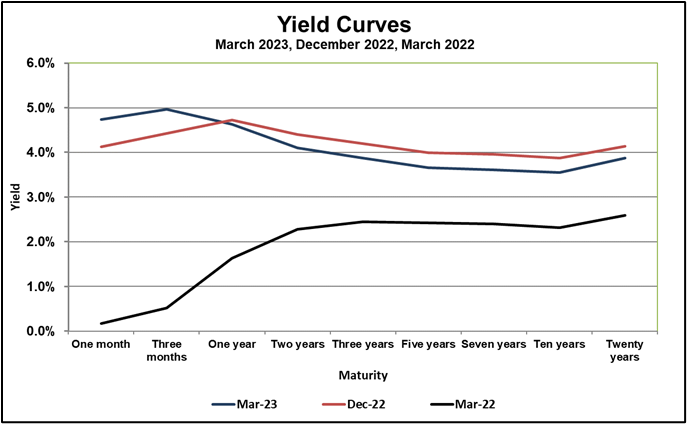

As usual, there are a number of smoking guns. Perhaps the biggest shot has come from banks that have been holding exceptionally large reserves of low-yielding bonds in today’s higher interest rates.

In the case of Silicon Valley Bank (SVB), for example, its tech-heavy clientele deposited large amounts of cash during the pandemic when the industry was awash in undeployed assets. In turn, the bank used the money to buy Treasury and other bonds. [Source]

As interest rates rose, prices for SVB’s bond holdings fell. Normally, this wouldn’t be a problem; whether you’re a bank or an individual investor, as long as you simply hold low-yielding bonds to maturity, you can expect to be made whole at the end. But if too many of a bank’s customers pull out their money all at once, the bank may be forced to sell their low-yielding bonds at a loss, to meet the sudden demand for cash. Just as in the classic film “It’s a Wonderful Life,” these sorts of bank runs can spin out of control.

What’s Going To Happen Next?

In the midst of the fray, it would take far more hubris than we have to predict the future. That said, here are our observations to date:

Bank Risks: To date, it would appear that the most at-risk banks are those that are:

- Serving clients in cash-heavy industries, such as technology, cryptocurrency, venture capital, and private credit; and

- Perhaps more significantly, holding large percentages of uninsured deposits.

To expand on that second point, today (versus during the Great Depression’s bank runs), the FDIC insures up to $250,000 of each bank customer’s deposits. If you’re married, each of you receive protection of up to $500,000 on a joint account. If an account exceeds FDIC limits, the excess is uninsured. In the case of SVB at year-end 2022, its deposits were valued at around $200 billion, but only about $30 billion of those deposits were insured. That translates to a lot of big accounts with uninsured balances. [Source]

Government Action: As we might expect, the government is not sitting idle as events unfold. It’s “all hands on deck,” with rapid-fire announcements coming out of the Treasury Department, the Federal Reserve, and the FDIC.

- To staunch the immediate “bleeding,” these Federal institutions are taking a number of joint emergency actions to protect affected account holders, in some cases promising to protect even those whose accounts exceed FDIC insurance levels.

- There is also talk of walking back the originally projected March 21–22 Federal Reserve rate hike, to help stabilize banks’ bond reserves in general. Time will tell whether broad market predictions here prove correct. [Source]

- Discussion is underway on how to shore up any systemic concerns over time. For example, there’s already calls for re-tightening banking controls such as capital requirements and liquidity rules for small- and mid-sized banks. [Source]

As such, while the news is as noisy as usual when fear is in the air, we are cautiously optimistic a worst-case scenario is avoidable. That’s no guarantee. But if we place today’s news in historical context, the banking system has been under similar and worse strains, and remained resilient.

You and Your Money

In the meantime, there are your own cash reserves and investments. During times of heightened risk, the longing to take hurried action becomes a pull that’s often too strong to overcome on your own. Before taking any immediate steps, we urge you to talk it over with us.

Unfolding events do underscore one action that may be advisable from a “better late than never” perspective. If the cash you hold in any one bank exceeds FDIC protection (or, in the case of brokerage cash accounts, SIPC limits), there may be value in working out a plan for addressing that issue. That said, whether during the Great Depression or today, panic is rarely an advisable way to proceed.

Again, we are here. Our broad advice remains the same. Our particular advice is guided by your unique circumstances, and grounded in the context of financial best practices.