Each year the financial services company, Morningstar, issues a report of how actively managed funds performed relative to passive funds. Historically, actively managed funds have not performed as well as funds designed to simply replicate a market or published index. However, one argument active fund managers make is that they are “nimbler” during times of extreme volatility which leads to better performance. 2020 was a year of extreme volatility, so let’s see how they did.

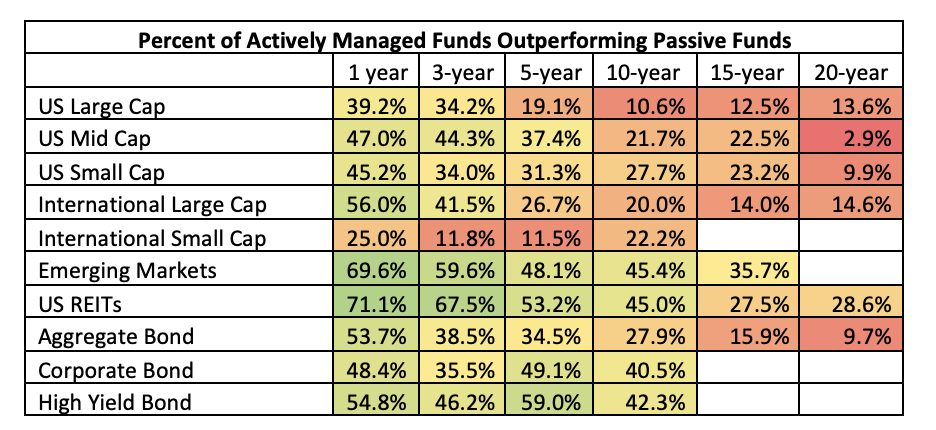

Compared to historical data, it was a good year for active management with active funds roughly matching passive funds across the board. Unfortunately for active management, a tie doesn’t help when you have two decades of severe underperformance to overcome. Looking back five years, active funds beat passive funds 37% of the time. In 10 years, it’s just 30%, and with 20 years of results, it’s a meager 13%.

The story here is one we know well, costs matter. With the track record reported by Morningstar, paying a large management fee for someone to pick stocks in an effort to beat the market has not behooved investors in the past and there is little reason to think that will change.

In addition to an expected return that is below market results, active management also introduces a new element of risk. Active funds often deliver returns that are different from a benchmark. These differences are random and cannot be modeled, making it more difficult to estimate future account balances and therefore, retirement spending.

Lastly, there is no way to predict which funds will perform best in the next period. Like daily movement of the stock market, relative manager performance is random.

Until we see a consistent trend reversal, we’ll continue to recommend passive funds for our clients’ portfolios. Knowing whether or not your investments are actively managed isn’t always obvious. Contact Rockbridge if you’d like us to review your portfolio.

Rockbridge works with several physicians in the Syracuse area, and more specifically, physicians employed at Syracuse Orthopedic Specialists. Through these experiences, Rockbridge has become well-versed with the benefit programs offered by SOS. Discussed below are two areas in which we have been able to add value to our clients employed by SOS.

401(k) Investment Options

The SOS 401(k) plan is held at Fidelity and has a few very good investment options. These options are well-diversified, low-cost index funds. The plan also has a full range of target retirement date funds. Most 401(k) plans are designed to use a target date fund as the default investment option for all new participants, which is not a bad place to invest if you want diversification without the need to research all the investment options.

However, not all target date funds are created equal (visit link here to read an article on the differences) and some are more expensive than others. In this plan specifically, the target date funds have an expense ratio of 0.60%, whereas a portfolio made up of individuals fund options in the plan, with a comparable mix of stocks/bonds has an expense ratio of 0.07%, which is less than 1/8th the cost of the target date fund. On an account balance of $1,000,000, the difference in costs is $5,300/year. This adds up over time. Over the course of a 25-year career of maximizing contributions to this plan, the difference in account balance could be as high as ~$280,000.

Outside of using more cost-effective funds to manage your investments, we also recommend implementing a goal-based allocation (mix of stocks/bonds) rather than an age-based strategy. For example, most 2020 target date funds now have a mix of 40% stocks and 60% bonds, whereas most 2025 funds have a mix of 60% stocks and 40% bonds. We want our clients to take an appropriate amount of risk for their individual financial goals, which shouldn’t change all that much between the end of their working career and retirement.

Defined Benefit Plan

The defined benefit plan offered by SOS is a great way to differ additional income for retirement, and we recommend maximizing contributions to this bucket for anyone who can. One thing to keep in mind is that the growth of your balance in this plan is tied to the interest rate of 30-year US treasuries. Today that rate is roughly 2%. Given that this account is tied to interest rates, we tend to look at it as a bond for the purposes of allocation.

For example, someone has $900,000 in their 401(k) and $100,000 in their DB plan and our recommended allocation is 70% stocks and 30% bonds. In this case, we would invest the 401(k) plan at ~80% stocks and ~20% bonds to offset the fact that 10% of investable assets are held in the DB plan.

These are just two of the areas of expertise we have been able to shed some light on for our clients. Whether you’re an employee at SOS, or just have general questions about either of the items discussed above, please don’t hesitate to schedule a call.