Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

March 23, 2021

Investing

Most of our clients hold bonds and most of those bonds have “lost value” in the first three months of the year. That does not mean any of the bonds have defaulted. In fact, almost no bonds have defaulted in 2021. Rather, interest rates have risen causing the value of existing bonds to drop.

It may seem counterintuitive that yields going up means bonds are worth less. At first glance, one might think if bonds are now paying higher interest rates, they should be worth more. While that is relatively true if you are buying new bonds, the bonds investors hold are bonds that have been issued in the past.

For example, say on 1/4/2021 Nick bought a 1% U.S. Treasury Bond for $100. If Nick wanted to sell it the next day, Nick would have gotten about $100. Fast-forward 3 months and $100 can buy a bond of the same length but with a yield of 1.75%. If Nick wants to sell his bond today, a buyer won’t be willing to pay $100 for a 1% bond because that buyer can now get a 1.75% bond for $100. To entice someone to buy it, Nick will have to lower the price.

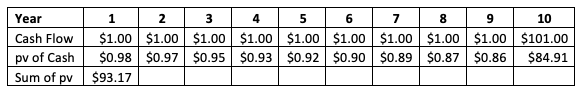

The following (simplified) table shows how a 10-year bond’s price would be calculated assuming that the bond pays a 1% coupon, and the current interest rate is 1.75%.

In this scenario, Nick will have to lower his price 6.83% in order to find a buyer. His bond has accrued 0.25% of interest, but he still will have lost 6.58% on the investment.

It’s good to remember that changes in interest rates can work in an investor’s favor. At the start of 2019, the aggregate bond market was yielding about 3%, and yet returned 8.8% for the year. At the start of 2020 it was yielding a little more than 2% but returned 7.7% that year. One way to think of it is that we got most of the upcoming decade’s return paid to us in the last two years.

Let’s see how interest rates have impacted returns so far this year. The rise in interest rates is what caused bonds to drop in value. The most common bond holding is an aggregate bond fund. Vanguard’s Total Bond Market (VBTLX/BND) has an average bond duration of 6.6 years. 7-year treasuries have seen a 0.74% increase in yield this year. Multiply the interest rate move (0.74%) by the duration (6.6) and you get a price movement of -4.9%. That plus the interest earned, some movement in credit spreads, and stronger mortgage-backed performance, and you get a year-to-date return of -3.8%.

While this is painful in the short-term, it means future returns are higher, which will benefit investors over the long run. Regardless of short-term performance, bonds make sense for many people for the following three reasons.

Lastly, while interest rates are expected to rise, it doesn’t mean they will. At the start of 2019, the U.S. 10-year bond was at 2.66% and expected to rise. A year later it was at 1.88% and again forecast to rise. At the start of this year, it was yielding 0.93%. No one knows what interest rates will do in the future, so we will maintain our discipline and continue holding bonds.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.