Every six months, Morningstar releases their “Active/Passive Barometer.” We feel Morningstar is a good source of data as they tend to be unbiased. While Vanguard or Dimensional Fund Advisors will always tell you passive is better, and active fund managers will always mine data that trumpets the benefits of active management, Morningstar is close to neutral.

Each day Morningstar runs articles giving positive reviews to active managers but also articles on the shift in the industry out of active management into passive funds. Investment managers who select funds pay to use their star system and see reviews of fund management in determining which active funds to select. We believe Morningstar is a good source of objective analysis (if anything would support active management) when it comes to analyzing active vs. passive performance.

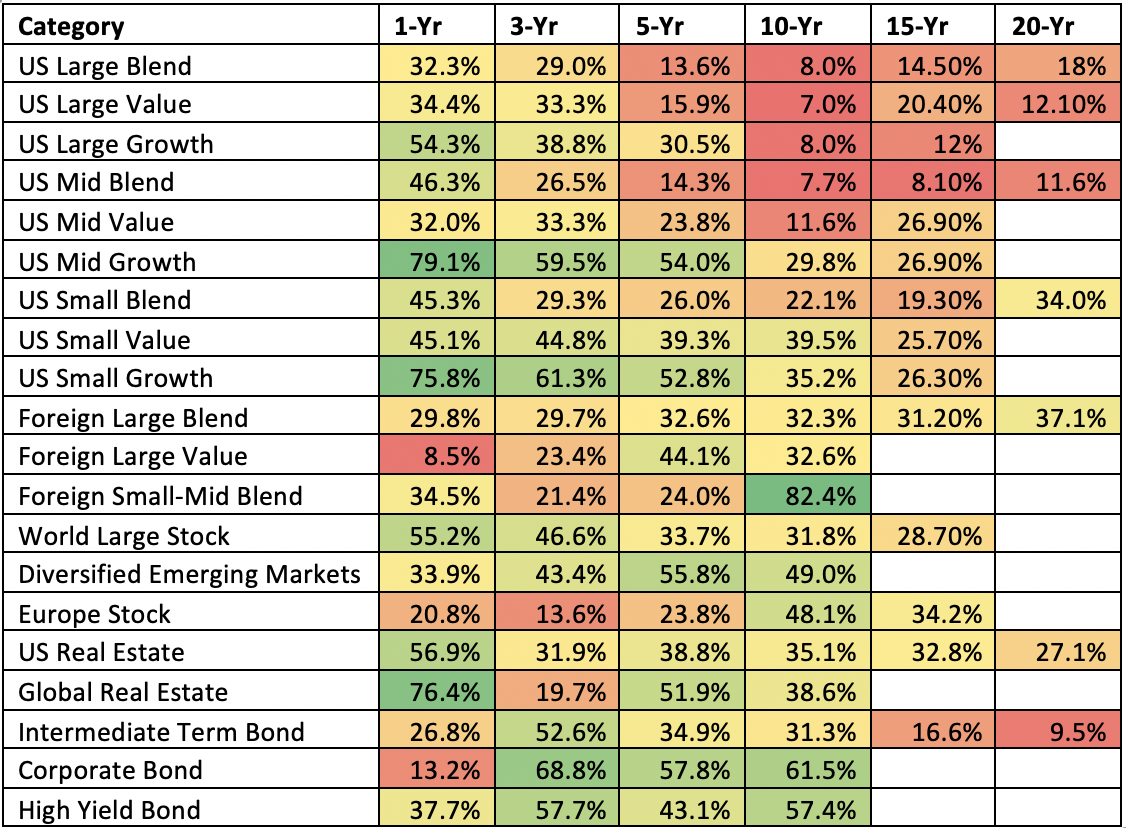

As seen below, Morningstar’s research shows that paying for active management is a bad bet for investors. The following table notes what percent of active management has beaten comparable passive funds over a given time period. The data was compiled as of June 30, 2019.

The data is clear, active management has a low success rate. Of the 101 numbers in that chart, 82 of them are below 50%. It’s also important to note the longer the time period, in general the less likely it is for active management to outperform a passive fund.

There does seems to be one anomaly and one exception to the rule. The 10-Yr Foreign Small-Mid Blend number is very positive. Active managers in that space will say the market is less efficient so there is more opportunity for a manager to add value. Perhaps there is truth to that, but then it doesn’t explain the dismal performance over the last 1, 3, and 5 years. Looking through Morningstar’s data, this category is very small. Only 17 active funds and 7 passive funds were around 10-years ago (compared to 451 & 122 in US Large Blend). We’re dealing with a small sample size, five to ten years ago, and the passive funds likely were relatively poorly managed and expensive compared to what is available today.

The corporate bond space is an exception to the rule, though it can be explained. Overtime, more credit risk (higher yielding, riskier bonds) should outperform higher credit quality bonds. And with normal sloping yield curves, longer duration bonds should outperform shorter duration bonds. If you wanted to manage a corporate bond fund and outperform your index, or a passive fund tracking an index, you should tilt your holdings to higher-yielding, longer bonds. For the last 10 years, companies have fared well and interest rates have fallen, both helping the tilts of active bond managers. We see this manifest itself in the 3, 5, and 10-year performance. In the second half of 2018 when stocks did poorly active managers got beat handedly by passive funds as credit exposure was a negative. Going forward we expect active corporate bond managers to outperform, but they are taking on a different risk profile. As comprehensive financial planners, we aren’t interested just in your bond holdings, but rather the performance of your entire portfolio. We look to manage the duration of a bond portfolio and credit quality as it relates to entire holdings, including your stock positions. Because of this, we believe passive funds still provide the best exposure for investors in that segment of the market.

In summary, data continues to support passive funds outperforming active funds across multiple asset classes and over most periods of time. This has persisted for many years and we expect it to continue into the future. On the whole, active fund outperformance is mathematically impossible as they charge more, and the sum of active management is the market as a whole. There also hasn’t been a model yet that can consistently identify active managers who will soon outperform. It seems the only group sure to benefit from active management is the fund managers who charge the high fees.