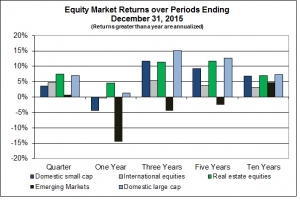

In 2015, domestic large cap stocks (S&P 500) and REITs were up while other markets were down – emerging markets were off big! The positive results in the S&P 500 were driven by just two stocks – Amazon and Google. Otherwise it would have looked like other market indices. These results, I think, reflect ongoing economic uncertainty throughout 2015, much of which is still unresolved. Examples include: (1) Where is the bottom for commodity prices? (2) What is the strength of the dollar as Europe eases its monetary policy and U.S. tightens it? (3) Are interest rates withering? The lack of resolution of much of this uncertainty will contribute to continued stock price volatility, which has certainly been the case so far in 2016. The first week in January has the feel of panic – we’ll see.

Daily volatility of stock prices was up in 2015. This is especially apparent over the last couple of months and into the beginning of 2016. Yet, the 2015 experience was pretty much in line with how stock markets have behaved historically. We have become used to above-average returns with less volatility from the widely followed domestic markets in the recent past. The 2015 story was different – below-average returns with greater volatility.

Bond Markets

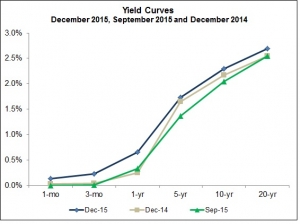

After keeping us in suspense most of the year, the Fed voted to increase the rate on Fed Funds (rate at which banks lend excess reserves to one another overnight) by 0.25%. This much anticipated change was met with a loud ho-hum – surprises are what move markets. The accompanying Yield Curves chart, which shows yield to maturity from U.S. Treasury securities  of different maturities, depicts increases at the short end with slight increases at longer maturities. Yet, not much of a change overall.

of different maturities, depicts increases at the short end with slight increases at longer maturities. Yet, not much of a change overall.

While the impact of changes in the Fed’s policies on bond markets and where we go from here continues to provide uncertainty, I think a little less distortion of capital markets from the Fed’s activities is welcomed.